A Global Strategic Imperative

Delivering Sovereign Financial Infrastructure at Speed.

What we do

Bancstac is your award-winning partner that delivers control back to banks, governments and corporates.

-

Bancstac builds, hosts, and maintains proprietary cloud-native bank infrastructure and technology platforms used for global banking.

We modernize, enhance and replace legacy systems and deliver bank-led payment innovations.

Bancstac offers a politically neutral solution for financial infrastructure and fintech innovations that are decoupled from foreign technology dependencies which can expose domestic financial ecosystems to extraterritorial overreach by foreign regulations - a critical systemic risk in an increasingly polarized economic world order.

WE DELIVER TRUST

Delivering Ecosystem Trust for Global Commerce.

Bancstac solves complex banking infrastructure and payment technology pain points for partner banks and their corporate clients.

We provide a fully hosted, politically neutral technology foundation that bridges the gap between legacy bank systems and modern global banking demands. We make it seamless to participate in the global economy by building financial transaction trust between businesses and people around the world.

Our commitment to providing secure, reliable, and scalable bank platforms has allowed leading financial institutions to confidently place their trust, and associate their own reputations, with Bancstac.

WE PROVIDE CLARITY

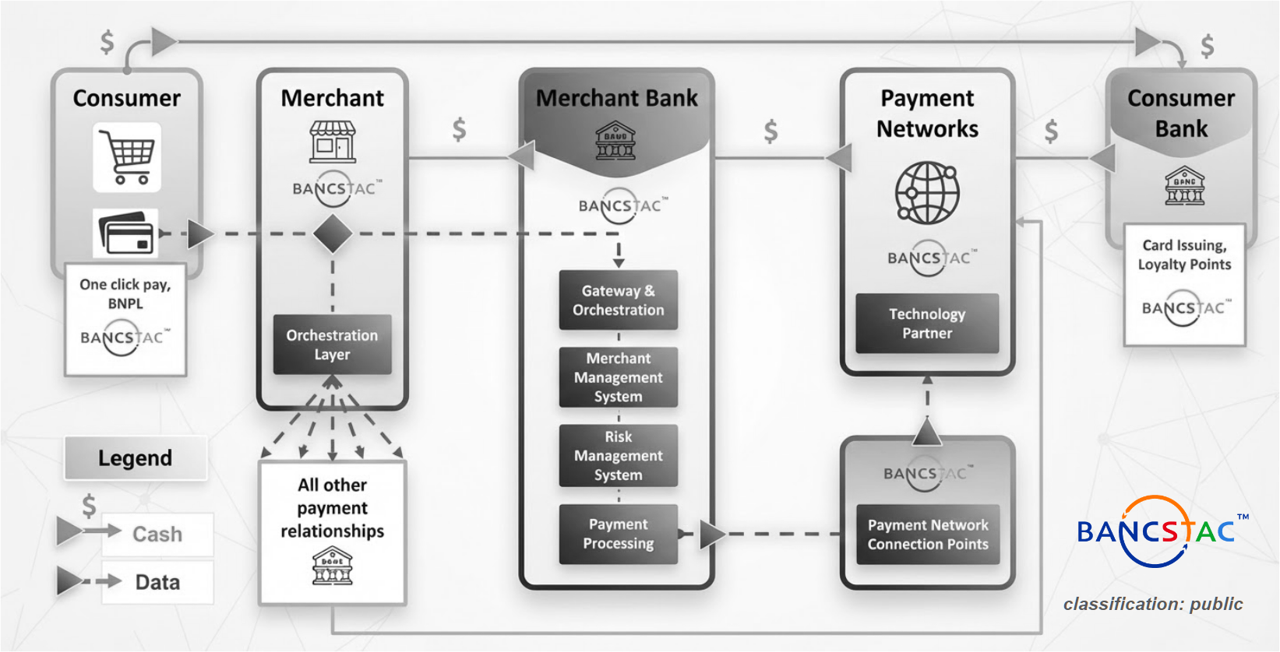

Merchant Acquiring Management Platform, Omnichannel Payment Orchestration and Data Driven Actionable Intelligence.

Our modular technology platform enables financial institutions to establish, efficiently operate, and scale a digital-first merchant acquiring business unit.

✔ 🌐 Payment Network Agnostic: Seamless integration between legacy banking systems and any payment network / method.

✔ 🪄 Omnichannel Payment Acceptance: Empowering banks and banks’ corporate clients to seamlessly accept payments from any channel, anywhere in the world.

✔ 🚀 Innovation at Fintech Speed: We develop, deploy, host and maintain scalable payment innovations for banks without impacting core banking systems.

✔ 🧩 Modular Banking Platform: Banks and banks’ corporate clients can pick and choose specific modules applicable to their needs.

✔ 🤖 Legacy Modernization: We remove technical blockages slowing innovation velocity by seamlessly integrating with, augmenting, or completely replacing bank legacy systems without disrupting core operations.

✔ 👷♂️ End-to-End Managed Operations: Our experienced integration team deploys, tests, operates, and maintains the entire Bancstac technology platform, releasing bank staff to focus on core competencies.

WE INTEGRATE VERTICALLY & HORIZONTALLY

WE DISRUPT DISRUPTORS

We Disrupt the Fintech Disruptors with Bank-Led Bancstac Fintech Solutions.

We strongly believe that banks, not third-party fintechs, should lead the digital payments revolution. As agile fintech companies attempt to erode direct-to-merchant relationships, Bancstac provides the disruptive answer for traditional banks.

Our innovative tools empower banks to foster data-driven, value-added dialogues with merchants. Because Bancstac is fully integrated into the bank’s legacy technology stack, our platform remains under full control by the bank. We provide the cutting-edge technology enabling banks to unlock new value for their customers, increase client wallet share, expand profit margin, and strengthen its competitive position in the marketplace.

WE INNOVATE WITH URGENCY

Bank-Led Innovation Launched at Fintech Speed.

Keeping pace with changing corporate banking needs and staying ahead of a rapidly evolving payment technology ecosystem is a heavy burden requiring sustained financial investment into R&D. We alleviate that pressure by continuously upgrading our technology stack, innovating in areas requested by our bank partners and their corporate clients. We handle all the complex bank-side legacy, and corporate enterprise, system integrations.

By accelerating the adoption of digital payment infrastructure, we create a thriving financial ecosystem:

✔ 💳 For Payment Networks and Alternative Payment Rails: We help accelerate integration, certification, and securely host and maintain direct connectivity between bank mambers and payment networks/alternative payment rails.

✔ 🏦 For Banks: We help drive profitable growth of corporate wallet share while drastically reducing operational and compliance costs.

✔ 🏢 For Merchants: We help increase sales, provide access to low friction payment capabilities and orchestrate complex payment transactions.

✔ For Consumers: We provide global access to goods and services, delivering the joy, ease, and trust of a secure low friction payment experience.

WE INVEST INTO WIN-WIN PARTNERSHIPS

Investing Time, Money, Expertise and Goodwill into Win-Win Partnerships for the Long Term.

Bancstac philosophy is rooted in shared prosperity. Alongside our foundational partnerships with banks, payment networks and global corporates, Bancstac is backed by a prominent multi-family office, as well as significant investments from our own deeply committed and all-in management team. Building sovereign financial infrastructure for the future of global banking in a highly polarized world requires vision, conviction, expertise, capital, and sustained collective action between strategic partners.

We don't provide static software systems; we actively invest in our bank partnerships by working closely with banks, global payment networks, government and corporates to identify real pain points, then developing and supporting scalable solutions to solve them.

Traditional banking environments often face complex internal impediments. Our flexible business model is specifically attuned to elininating the barriers to bank-led innovation, including:

✔ 💰 Cost Barriers

✔ 🚧 Technology & Legacy System Barriers

✔ 💣 Multi-Jurisdiction Compliance Barriers

✔ 👁️🗨️ Reputation Risk

With Bancstac, banks can rapidly test and implement new solutions, refine business models in real-time in response to changing market forces, aggressively pursue new growth opportunities, and defend against disruption.

WE IMPACT & INFLUENCE EVERY SECTOR OF THE ECONOMY

Our financial infrastructure and payment technologies power payment transactions across every sector of the economy.

While our foundation is grounded in providing sovereign infrastructure for banks, our platform is multi-jurisdictional and provides robust capabilities for the global banking needs of corporations and governments.

🏛️ Government Agencies & Public Sector

🛡️ Insurance & Financial Services

📱 Telecommunications & Media

📦 Logistics & Supply Chain

🚁 Travel, Accommodation & Entertainment

💼 Professional Services